Comply World(CW) - Your International Risk Management Partner, Leading Compliance in Africa

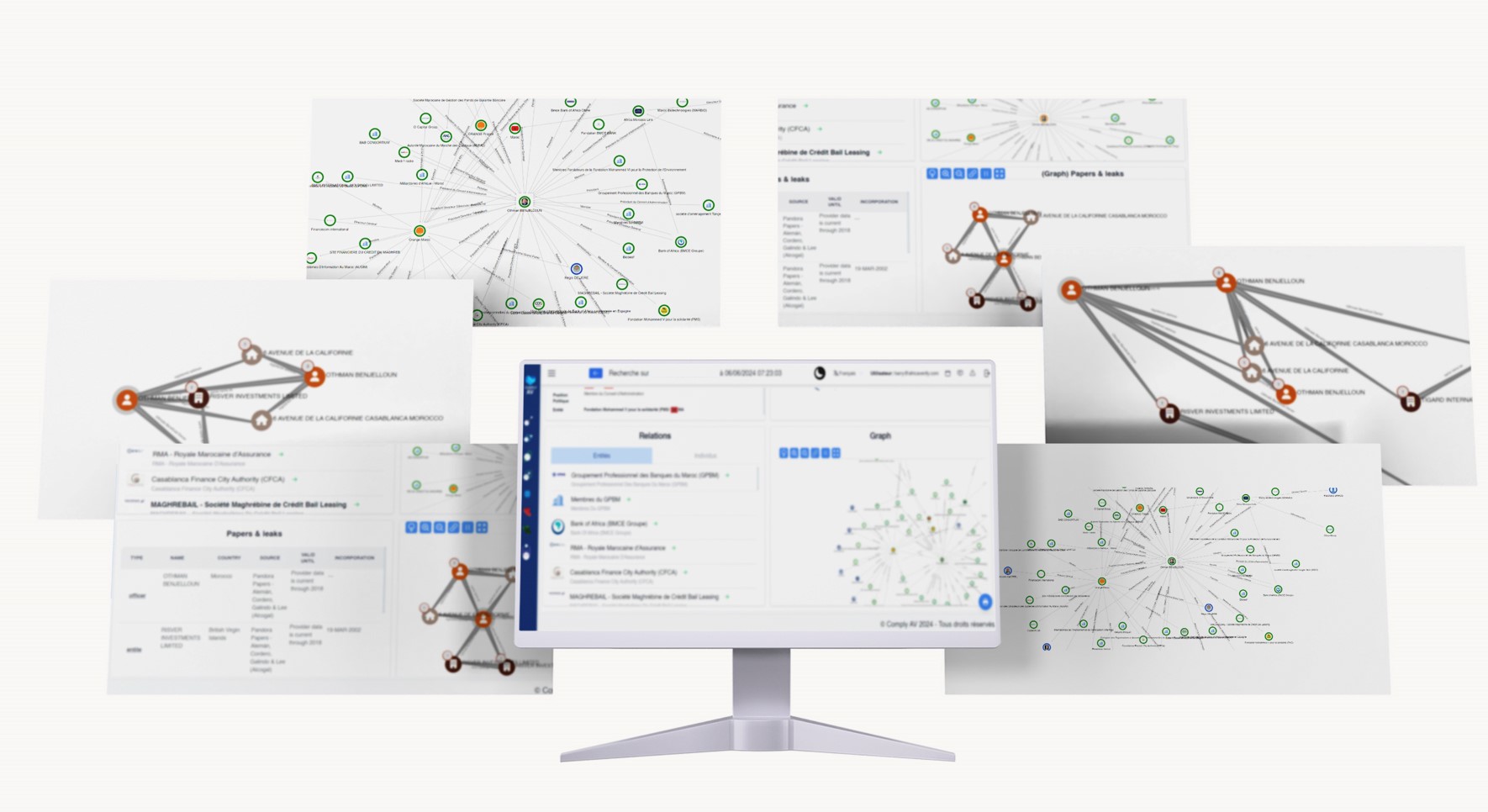

Comply World(CW) is an international company providing risk management solutions and a leader in compliance across Africa, offering a unique combination of advanced technologies and structured data.

Our global and tailored network is designed to meet the specific requirements of each country in combating money laundering and terrorist financing (AML/CTF).

Services and Solutions

Services and Solutions Core Activities

Core Activities Target Clients

Target Clients Differentiation Comply World

Differentiation Comply World